WFP Opportunity Fund

Higher Risk-Adjusted Returns

WFP Opportunity Fund – Higher Risk-Adjusted Returns

The WFP Opportunity Fund (the “Opportunity Fund”) seeks to provide higher risk-adjusted returns to its investors through real estate-based private debt and equity investments within the United States.

Targeting higher returns on shorter-term portfolio investments, the Opportunity Fund offers access to a diversified pool of direct and indirect equity investments, joint ventures, deeds of trust and mortgages, mezzanine financing, participating loans, and other real estate secured investments.

Benefits of Opportunistic Income Strategies

Opportunistic income strategies have emerged as a compelling diversification tactic for investors prioritizing upside potential with effective risk management. The Opportunity Fund is well-positioned to offer a combination of higher yields, potential participation in certain gains, and principal protection through diversification.

Investing in the WFP Opportunity Fund

Since 2013, the Opportunity Fund brings a track record of navigating real estate cycles and capital dislocations to unlock risk-adjusted advantages, generating revenues primarily through the participating return on its investments and on the interest paid on the private real estate debt investments in its portfolio by the underlying property owners. With a target net annualized return between 8%-12%, below are some key drivers of the Opportunity Fund’s performance.

Diversification: By strategically allocating capital across a spectrum of borrowers and sponsors, property types, debt and equity structures, maturities, and other attributes, the Opportunity Fund seeks to diversify its exposure and reduce correlation across asset classes and investment strategies to help mitigate risk and enhance returns for investors.

Risk-Adjusted Returns: The Opportunity Fund prioritizes potential income-generating and growth investments, utilizing a tiered structure to protect capital and enhance profitability. Trust deeds and mortgages are debt positions, providing a direct claim on the underlying real estate, with cash flow through interest paid on the loans. Participating loans and mezzanine financing are structured with direct or indirect collateralization by the property itself or ownership interests. Unsecured, preferred equity investments benefit from preferential treatment, ranking ahead of sponsorship equity interests. Additionally, participating loans and preferred equity offer the advantage of preferred profit participation, potentially amplifying returns based on the success of the underlying real estate assets.

Conservatively underwritten: Each investment is conservatively underwritten to determine the merits of the loan or investment, return potential, factors that may impact returns, and ways to help mitigate down-side risk. Further, our experienced team evaluates each investment by factoring in economic trends, local market dynamics, and property positioning by leveraging our deep expertise in real estate finance to deliver higher risk-adjusted returns.

No correlation to stock or bond markets: The Opportunity Fund offers accredited investors access to income strategies without exposure to stock or bond market volatility that align with their investment goals and preferences.

Little to no interest rate sensitivity: While changes in interest rates can significantly impact the value of traditional investments, the Opportunity Fund experiences little to no sensitivity to interest rate fluctuations.

The Opportunity Fund’s Advantage

Higher Risk-Adjusted Returns

Investors can benefit from higher yields and lower risk through the Opportunity Fund’s key attributes:

- Higher yields

- Quarterly Distributions

- Participation in Underlying Gains through Equity and Hybrid Debt / Equity Investments

- Principal safeguards

- No Correlation to Stock or Bond Markets

- Little to No Sensitivity to Interest Rates

- No Load or Commissions

- Secured by Hard Asset - Real Estate

- Portfolio Diversification

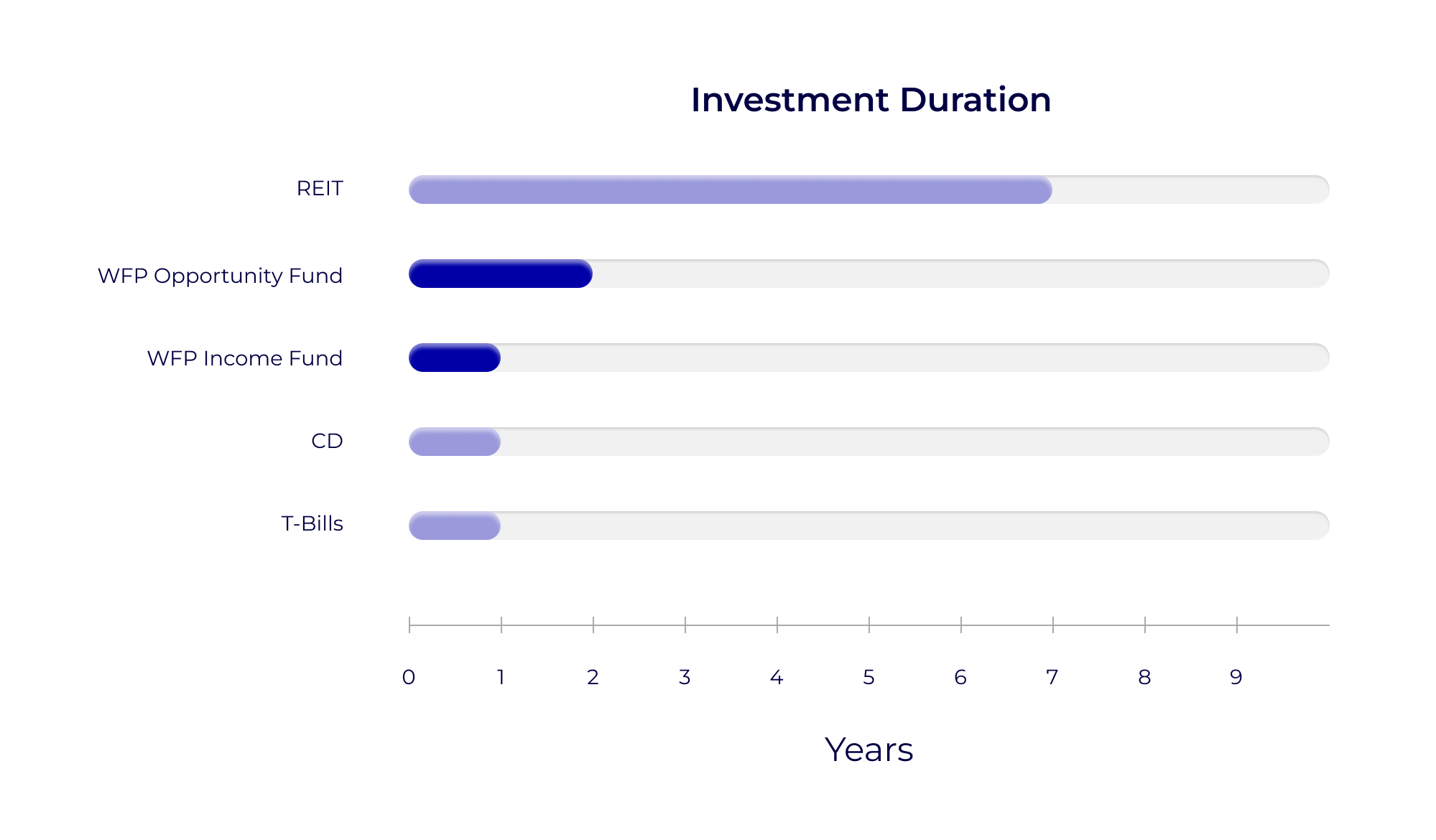

- Greater Liquidity Compared to Non-Traded REITS and other Real Estate Investments

- Shorter Investment Horizon Compared to REITS and other Real Estate Investments

- Experienced Management Team

Loan Performance

Performing Loans

100%

REO

0%

NON-PERFORMING LOANS

0%

*as of March 31, 2024

Portfolio Allocation

The Opportunity Fund is designed for accredited investors who seek a diversified portfolio of both debt and equity investments to achieve a balance of higher risk-adjusted returns and downside risk protection.

As compared to our more conservative WFP Income Fund, the Opportunity Fund’s investment objective is to seek higher risk-adjusted returns through debt and equity investments in opportunistic real estate strategies. Therefore, the Opportunity Fund is used by accredited investors who can accept a higher degree of investment risk in exchange for higher potential returns.

For investors with a more conservative risk tolerance, learn more about the WFP Income Fund.

Email investments@wilshirefp.com, request an investor package, or call us at (866) 575-5070 if you have any questions.

Regarding Potential Risks

Chances are remote that an investor would lose their entire investment. First, each member will have funds invested in a diversified portfolio of mortgages, deeds of trust, mezzanine debt, participating loans, and equity investments in real estate. For someone to lose their entire investment, many things would have to go wrong simultaneously.

For example, with respect to the loans in the portfolio, all of the loans within the portfolio would have to quickly go into default, the Fund would have to obtain all of its properties at foreclosure transactions without any third parties overbidding the Fund, and a situation would have to arise where there would not be a single buyer for any of the properties, regardless of price. Further, with respect to the equity investments, the value of each of the properties would need to experience such significant impairment that there would be no recovery if the property were sold. The likelihood of all of these happening at once is practically impossible.

As is consistent with the nature of many investments, there is always the possibility of losing a portion of your invested principal. In the event that a loan within the Fund portfolio defaults, a foreclosure may occur. When that happens, there is a chance that the foreclosed property might sell for less than the amount of the loan, causing a loss. If the value of the property underlying an equity investment drops below the breakeven point for the investment, a loss would occur. Such losses, however, should be minimal.

For example: The Fund makes a second loan of $500,000 behind a first loan of $3,250,000 to a borrower purchasing property for $5,000,000, which combined represents $3,750,000 in loans or 75% of the property’s value (also known as a 75% combined loan-to-value or 75% CLTV). Because of market or other conditions, the property value decreases and after default and foreclosure, the Fund sells the property for $3,550,000 (or a 29% reduction in the original purchase price), resulting in a $200,000 loss for the Fund. Assuming the Fund has $10,000,000 in portfolio investments and a member/investor has invested $100,000 (or 1% of the Fund). The investor’s pro rata share of the loss would be $2,000 (or $200,000 x 1%). Conversely, if the Fund’s anticipated annualized return is 10%, the loss could be absorbed through a reduction in the return distributed to all investors in the Fund by reducing the return from 10% to 8% (or $1,000,000 gross return - $200,000 loss = $800,000 adjusted return / $10,000,000 portfolio investments) to mitigate or eliminate the impact of the loss to the investor’s principal investment. This example is for illustrative purposes only and if a loss occurs the actual results may vary.

In order to help mitigate the costs and potential losses in the Fund’s portfolio, the Fund seeks to diversify its investments across borrowers and sponsors, property types, investment structures (debt and equity), duration, and other attributes. Further, each investment is underwritten to determine the merits of the loan or investment, the return potential, factors that may impact returns and ways to help mitigate down-side risk. While diversification and underwriting will not eliminate the potential for loss in all investments, it should assist in buffering the impact of losses in the portfolio should they occur.

While money invested in real estate, including, direct investments and indirect investments, will be subject to some form of risk, as compared to other funds, real estate limited partnerships, equity REITs, and other structures making equity investments in real estate, the Fund is designed to have diversified portfolio of both debt and equity investments to achieve a balance of higher risk-adjusted returns and down-side risk protection.

In order to seek higher risk-adjusted returns, the Fund will invest in various forms of debt and equity and, therefore, will have different risk exposures depending on the type and structure of those investments. Some of the risks that the Fund will accept will be similar to the risks of direct real estate investment and investing in real estate through limited partnerships, real estate investment trusts (REITs), and other structures. Those risks may include: the use of debt or leverage which is senior to the Fund’s invested capital, changes in real estate valuations, interest rate changes, and the risks attendant to the ownership, management, and operation of real estate. As a result, the Fund seeks to mitigate risk through stratification and diversification.

Stratification across different forms of debt and equity will assist in mitigating risk as compared to other real estate investments using a singular or more narrow approach. For example, loans secured in a first or subordinate lien position, mezzanine debt, and participating loans are superior to equity therefore will have a lower risk profile than equity. Preferred equity generally has rights, preferences, and privileges superior to common equity. Therefore, as opposed to focusing on a singular structure or more narrow approach (e.g. 100% equity investments), the Fund will seek to mitigate risk by stratifying its lending and investment approaches.

In addition to stratification, the Fund will seek to diversify its loans and investments across borrowers and sponsors, property types, geographic location, and other factors to reduce portfolio risk. This diversification will avoid a concentration of risk often seen with real estate limited partnerships and investments holding a single property or multiple properties with the same asset type, sponsors, and/or structures.

Because the Fund is targeting investments with shorter investment horizons, that may assist the Fund with managing variables impacting longer term investments, provide faster potential returns, and create greater potential liquidity. Further, while exchange traded funds, partnerships, REITs and other real estate-backed securities will have a higher degree of liquidity, such investments are subject to greater volatility due to changes in interest rates or the markets in which they trade. Conversely, because the Fund is not exchange traded and it anticipates holding shorter-term investments in its portfolio, the Fund is potentially less susceptible to the impacts of market and interest rate fluctuations.

As compared to the WFP Income Fund—a more conservative fund investing in first mortgages and deeds of trust secured by real estate at lower loan-to-value ratios—the Fund’s investment objective is to seek higher risk adjusted returns through various forms of debt and equity investments. Therefore, the Fund should be considered by parties who are willing to accept a higher degree of investment risk in exchange for higher potential returns.

As seasoned investors already know, the principal invested in stocks, bonds, and mutual funds may rise or fall, create gains or losses, due to a number of factors, including, the fundamentals of the underlying investments and fluctuations in respective markets in which those investments trade.

If “alternative investments” is defined as everything other than stocks, bonds and cash, the universe of alternative investments is very large, and the risk in each category of investment is varied, will differ in each potential investment in those categories, and may change based on a number of factors, including, changes in economic conditions, law and regulation, market conditions, and other factors. Therefore, a comprehensive discussion of risk of all alternative investments is beyond the scope of this discussion. A better approach for an investor may be to compare the risk of the Fund relative to other alternative investments in their portfolio and under consideration.

To assist with that comparison, investors may consider the following risk categories as a starting point:

- Market Risk. Market risk includes increases or decreases in an investment's value due to volatility or fluctuation in the respective market in which those investments trade, and for real estate-based investments positive and negative impacts to the real estate market.

Exchange traded investments may have direct correlation to the stock and bond markets and/or interest rates, and some may be subject to volatility or fluctuation driven by factors completely unrelated to the fundamentals of the underlying investment or investment quality such as investor sentiment, potential monetary action, geopolitical impacts, news, and other factors.

Because the Fund is not exchange traded and it anticipates holding shorter-term loans and investments in its portfolio, the Fund is non-correlated to the stock and bond market and has little to no sensitivity to interest rate changes. Therefore, the Fund is potentially less susceptible to the impacts of stock and bond market volatility and interest rate fluctuations.

With respect to real estate market risk, the Fund will lend against and invest in real estate-based investments. Real estate values underlying these loans and investments are not immune from fluctuation or change. Real estate values have changed in the past and will change in the future.

What is unique about the Opportunity Fund is the blend of risk mitigation strategies in place, as outlined below.

-

- Shorter-term real estate investments with terms of approximately 1 to 3 years and holding those loans to maturity allows the Fund to react to real estate values and interest rates more quickly as compared to being locked into a 30-year mortgage. Additionally, the Fund has the opportunity to better gauge potential future market conditions over a 1- to 2-year time period as opposed to projecting market conditions 7 to 10 years into the future.

- Diversification across a number of segments, versus a pool of homogeneous loans, helps to mitigate the risk of an entire pool of loans and investments negatively reacting in a similar fashion at the same time. The Fund segments by geography, property types, borrowers, sponsors, maturities, rates, terms, and other mitigating factors.

- Interest Rate Risk. Interest rate risk is the potential for losses that result from a change in interest rates. For example, because of the inverse relationship between bond prices and interest rates, an increase in interest rates may result in a decrease in bond prices. Further, rising interest rates may negatively impact the capitalization rates used to value income producing real estate and the costs of operation.

Because the Fund invests in loans with terms of approximately 1 to 3 years and holding those loans to maturity, the Fund is better able to react to changes in real estate values and interest rates as compared to being locked into 30-year mortgages.

With respect to participating loans, equity investments, and other investments, the Fund targets opportunistic acquisitions and value-add investments with shorter investment horizons—generally 1-to3 years—with greater certainty of execution and upside potential. Shorter term opportunistic and value-add investments give the Fund the opportunity to better gage potential future market conditions compared to longer term investments and helps to reduce execution risk.

- Liquidity Risk. Liquidity risk involves the illiquidity of an investment or the inability to quickly or easily exist an investment or convert to cash. While exchange traded investments may have greater liquidity, the tradeoff is market risk and volatility.

Unlike other alternative investments that may have very long investment horizons (e.g. REITs with 7 to 10 year investment periods), the Fund allows investors to withdraw all or a portion of the investment after an initial 24-month period has passed. After that period, an investor may withdraw up to the lesser of 25% of your investment or $100,000 every consecutive 3 months. Additional restrictions on withdrawals may apply.

By having shorter-term investments with staggered maturities in the Fund’s portfolio, the Fund has internal liquidity as loans repay and investments are harvested to help meet redemption requests.

- Regulatory Risk. Regulatory risk includes the risk that a change in laws or regulations will adversely affect a business, business sector, market or investment, or their respective prospects.

As an industry, real estate is subject to direct and indirect impacts of changing laws and regulations that may adversely affect a business, sector, market, investment, or other respective prospects. During the COVID-19 pandemic, stay in place orders and prohibitions against gathering had both direct and indirect impact on certain real estate segments, such as hospitality and retail properties. Moratoriums on evictions and foreclosures impacted both owners and lenders in multifamily and other residential properties.

A certain level of regulatory risk is inevitable and an accepted part of real estate-based investments and, with certain exceptions such as the emergency regulations described above, can be foreseen and managed. For example, laws and regulations related to leasing and tenant rights are an accepted part of the real estate business and can be managed.

Because of the nature of its operations, the Fund will be exposed to certain forms of regulatory risk and will seek to mitigate regulatory risk by managing existing requirements and foreseen changes where the regulatory risk is at an acceptable level for the applicable loan or investment. The Fund will avoid regulatory risk by not engaging in certain forms of investment where the risk is not in alignment with the Fund’s objectives or outweighs the potential rewards, such as entitlement risk associated with raw land, development, and ground-up construction loans and investments due to its risk with obtaining discretionary and non-discretionary approvals for matters like zoning, site plans, etc.

- Operational Risk. Operational risk includes the risk of loss resulting from inadequate or failed internal processes, procedures, people or systems.

In a real estate context, operational risk often relates to the plan and positioning of the property in the market and the owner or property manager’s execution of that plan.

Operational risk exists in most real estate investments, with some risk being greater than others. For example, ground up construction and later stabilization after completion has greater operational risk than the operational risk associated with a well-positioned, existing property managing tenant rollover. Further, there is greater operational risk in hotels and certain seniors housing properties compared to multifamily or warehouse properties.

Because the Fund will lend against and invest in various property types and properties in transition, operational risk will be present in various degrees in the loans and investments made by the Fund. The Fund will seek to mitigate those risks by lending to and investing with borrowers and sponsors who have experience and a successful track record in the specific asset class and circumstances giving rise to the lending and investment opportunities.

- Principal Risk. Principal risk involves the potential loss of the principal amount of an investment.

As addressed in this document, the Fund will seek to provide principal safeguards through, among other things, the avoidance of certain risks, stratification and diversification in the Fund’s portfolio, shorter term lending and investment horizons, selection of borrowers and sponsors, and underwriting the strength and viability of the plan of execution.

- Other Risks. Investors are encouraged to investigate and inquire about other potential risks in all investments they are contemplating, including the Fund. For more information about the potential risks of investing in the Fund, please review the Memorandum, including the section entitled “Risk Factors.”

The actions taken will depend on the facts, nature, and circumstances of the default. Potential actions may include permitting additional cure periods, restructuring the loan, appointing a receiver to collect rents and manage the property, selling the loan, or foreclosing on the property. In the event the Manager elects to sell the loan, likely buyers may include junior lien holders or other investors interested in owning the property. The point is that there are a number of potential actions that may be taken by the Manager in an effort to protect and preserve the principal investment in the loan. That said, the Manager has the ability to act quickly and aggressively in the event of default.

There are a number of potential actions that may be taken by the Manager and those actions will depend on the facts, nature and circumstances of the default. Potential actions may include permitting additional cure periods, restructuring the loan, appointing a receiver to collect rents and manage the property, selling the loan, or foreclosing on the property. In the event that the Manager elects to sell the loan, likely buyers may include other investors interested in owning the property. In an effort to protect and preserve the principal investment in the loan, the Manager has the ability to act quickly and aggressively in the event of default.

Depending on the structure of the investment, the Fund may have various remedies available to it. Potential actions may include restructuring the investment, taking over and managing the property, selling the investment, or foreclosing on the property. Like a loan default, there are a number of potential actions that may be taken by the Manager in an effort to protect and preserve the principal investment in the property. That said, the Manager has the ability to act quickly and aggressively in the event a project is not performing.

Declines in real estate values, longer marketing periods, lower absorption rates and other factors in a declining market may have an effect on the Fund’s portfolio. Specifically, if the value of the property underlying an investment (whether a debt or equity investment) drops below the breakeven point for the investment, a loss would occur.

As an active market participant who has weathered several real estate cycles, the Manager’s principals have in-depth knowledge, expertise, and experience managing such risks. In anticipation of potential market changes the current underwriting philosophy employed by the Manager results in the use of third-party valuations (e.g. appraisals), market analysis, stress testing of cash flows, capitalization rates, and project projections, deal structure and other factors to help mitigate downside risk.

While there are no assurances that the Manager will be successful with all investments, in a waning market the Manager has the ability to review and revise its underwriting approach and stress testing as necessary to employ a more conservative approach to further address changing market conditions.

For more information about the potential risks of investing in the WFP Opportunity Fund, please review the Memorandum, including the section entitled “Risk Factors.”

About Rewards

The Fund has a targeted annualized return of 12%, net of all expenses, costs and management, and profit participation fees payable by the Fund. If members of the Fund receive a quarterly return of 3% (for an annualized rate of 12%), any net profits remaining after the members have received their quarterly return of 3% will be split 80% in favor of the members and 20% in favor of the Manager as a quarterly profit participation fee.

In order to achieve the net target return, the Fund will strive to achieve an annualized yield on the loans and investments in its portfolio which are higher than 12%, but the target yield and returns may change based on various factors, including changes in market interest rates, the economy, competition, individual investment criteria, and other factors.

Although the Fund plans to target an overall annualized net return of 12%, and we believe achieving that level of return is realistic, there is no guarantee that the Fund will be able to provide its members with these or any specific levels of returns in any given year or at all, and neither the Manager nor the Fund represents or warrants (whether expressly or by implication) that such returns will be achieved, whether in any segment of the Fund’s portfolio or on average.

Yes, it is possible that future returns may be lower than returns paid in prior periods.

Once the gains on any investments are realized, there is no guarantee that the Fund will find comparable quality investments at the same or a higher returns to replace them. Specifically, in order to stay competitive and maintain a portfolio of higher-quality investments, the Manager carefully monitors the market and adjusts its required rate of return on its investments as needed.

The Fund will also experience periods of time when committed capital is not fully invested in targeted real estate-related loans and equity interests. Those periods will include the initial capital-raising and investment periods (“Ramp-Up Periods”), the periods during which capital is committed to fund acquisitions, loans and project-specific allocated capital prior to deployment of the capital, committed funds immediately prior to the funding of a specific investment, funds returned immediately following a liquidity event, and other similar events. At such times, the Fund will seek to employ such under-invested capital in short-term, interest-bearing investments to temporarily generate additional income for the Fund. However, overall returns in the Fund will be affected by the under-deployment of capital.

It is unlikely that the rate of return earned by the Fund’s members will be inferior to the rates offered by banks, credit unions or other insured financial institutions on checking accounts, savings accounts, money market accounts and certificates of deposit with a similar duration as the Fund (i.e. initial 24 month investment period). The explanation is relatively simple: the financial models of those institutions differ from the Fund.

Banks and other insured financial institutions have an incentive to reduce their cost of funds (a large portion of which is based on the rate they pay on deposits) to ensure a healthy Net Interest Margin (NIM). Essentially, the Net Interest Margin is the spread between a bank’s cost of funds and the rates they charge on loans. All other things being equal, the greater the NIM or spread, the more potential profit the bank receives. In a low interest rate environment like the one we have experienced over the last several years, the deposit rates offered by some banks may be under 1%. Therefore, while the banker may have the same objective of protecting their depositor’s principal, the banker’s incentive is to maximize returns for their shareholders and themselves and not necessarily their depositors.

However, the Fund has an incentive to maximize investor returns. Unlike depositors in a bank, Fund members receive all distributable cash earned by the Fund. The distributable cash in the Fund is primarily the interest received on the loan portfolio and returns on the other investments made through the Fund, less the costs of operating the fund, working capital and loan loss reserves. As a result, the Fund has a targeted net annualized return to its investors of 12%.

Generally, the distributions would be treated as ordinary income. However, investments through IRA, 401K, pension and other qualified plans may receive more favorable tax treatment, such as the deferral of income taxes. We do not provide legal, tax, or accounting advice, and therefore, we recommend that you consult with your tax advisor about your particular tax situation.

Regarding Liquidity

The operating agreement of the Fund allows you to withdraw all or a portion of the investment after an initial 24-month period has passed. After that period, you may withdraw up to the lesser of 25% of your investment or $100,000 every consecutive 3 months. Additional restrictions on withdrawals may apply.

Further, in certain circumstances, the Manager may permit an accelerated or full withdrawal of invested funds. Earnings will accrue on your investment to the date of the withdrawal and there are no penalties for withdrawals.

There are several cash sources available for withdrawals, with the main source being loan payoffs and real estate sales or refinances related to the Fund’s equity investments. The Fund's portfolio consists of investments and loans with different investment horizons and maturity dates, creating a laddering effect where cash will come into the Fund at different times creating liquidity in the Fund to pay withdrawal requests.

Another source is cash entering the Fund through new subscriptions. Effectively, cash from a new subscription to purchase Units in the Fund may be used to pay an outgoing member's request for a withdrawal.

Lastly, although it is not required to do so, underlying loans and investments may be sold to generate cash within the Fund.

Generally, less than 1 month, but it could be as long as 3 months depending on how far in advance of the first day of the calendar quarter you invest.

Once the Subscription Documents are completed by the investor and investment funds are deposited into the Fund’s subscription account, the Manager must promptly accept or reject the Subscription Documents. If the Subscription Documents are rejected, the investor’s funds will be promptly refunded to that investor from the subscription account. If the Subscription Documents are accepted, the investor’s funds will be moved into the Fund’s general account on the first day of the calendar quarter following the acceptance of the subscription and the investor will become a member of the Fund on that date.

Subject to the Subscription Documents being accepted by the Manager, an investor’s funds may be borrowed from the Subscription Account at a rate of 4% per annum prior to the investor being admitted as a member of the Fund on the first day of the following quarter. Therefore, depending on when an investor invests with the fund (i.e. early in the quarter or later in the quarter), if accepted by the Manager, funds may be held in the subscription account from a few days to several weeks.

Fund Borrowers

Many of the Fund's borrowers are professional real estate investors and/or owners and operators of commercial and residential real estate. As such, they need an efficient lending source when capitalizing on market opportunities—and they are willing to pay a premium in the interest rate and fees on the loan in exchange for speed and efficiency. It becomes a business expense of the transaction. Therefore, because the Manager and the Fund have a funding platform that can deliver the speed and efficiency desired by those borrowers, they can command higher interest rates and fees than banks and other institutional lenders. This results in higher yielding loans in the Fund’s portfolio and higher risk-adjusted returns for the Fund’s investors.

Miscellaneous

The Fund has engaged the services of Armanino, LLP (“Armanino”) to perform an annual audit. Further, Armanino assists with a review of the Fund’s monthly reconciliations and member distributions.

Armanino is one of the largest California based Certified Public Accounting firms and one of the top 25 accounting firms in the United States. They have been providing accounting and consulting services for over 50 years. Armanino provides services to more California mortgage pools and funds than any other firm in the state and are rapidly becoming a national leader in this industry. Armanino is subject to review by the Public Company Accounting Oversight Board (“PCAOB”), a private-sector, nonprofit corporation created by the Sarbanes–Oxley Act of 2002 to oversee the audits of public companies and other issuers in order to protect the interests of investors and further the public interest in the preparation of informative, accurate and independent audit reports. Further, Armanino is a member of Moore Global (formerly, Moore Stephens), one of the world’s major accounting and consulting networks and provides access to over 260 independent accounting firms in 110 countries.

As described above, the Fund "bridges" the gap in timing or financing borrowers often experience when they need speed and efficiency to capitalize on a market opportunity, or before they can position their property for more traditional institutional financing or a sale.

Shorter and medium term loans and investments allow the Fund to manage its portfolio in several important ways. By keeping the terms of the loans short, the Fund has the ability to require existing borrowers to pay off or remargin (i.e. pay down the principal balance) their loans at maturity. This helps to reduce the risk of having a legacy portfolio of loans with longer maturities made at a time when property values were much higher.

This is also true of the Fund’s equity investments. By keeping the investment horizon short, the Fund is in a better position to assess the market conditions over a shorter term horizon. In addition, as loans and investments pay off, the Fund can make new loans and investments at the then current market values.

In a waning market, as opposed to being locked into the terms and conditions on longer term loans and investments, the Manager has the ability to review and revise its underwriting approach and stress testing as necessary to adjust to changing market conditions and mitigate overall portfolio risk as new loans and investments are made.

Lastly, shorter and medium term loans and investments create liquidity in the Fund’s portfolio to address withdrawal requests by the Fund’s members.

- Investment Type: The Fund is a professionally managed fund investing in shorter term loans and investments secured by real estate throughout the United States. It should be measured against other moderately aggressive to aggressive short-term, fixed income investments in your portfolio.

- Investment Objective: The Fund’s objective is to achieve higher return on shorter term portfolio investments through direct and indirect equity investments, joint ventures, deeds of trust and mortgages (including, first liens, second liens, B notes and other liens), mezzanine financing, participating loans, and other debt and equity investments. Therefore, the Fund will strive to obtain above average returns on a risk-adjusted basis while seeking to mitigate certain risks involved in real estate investments and real estate loans.

- Investment Strategy Justification: The Fund is a short-term, fixed income investment alternative that provides the following benefits:

-

- Higher Yields

-

- Quarterly Distributions

-

- Participation in Underlying Gains through Equity and Hybrid Debt / Equity Investments

-

- Principal Safeguards

-

- Quantifiable Equity Cushion

-

- No Correlation to Stock or Bond Markets

-

- Little-To-No Sensitivity to Interest Rates

-

- Shorter Term with a Two Year Hard Lock

-

- Greater Liquidity Compared to Non-Traded REITS and other Alternative Investments

-

- Shorter Investment Horizon Compared to REITS

-

- No Load or Commissions

-

- Secured by Hard Asset - Real Estate

-

- Portfolio Diversification

-

- Experienced Management Team

Email investments@wilshirefp.com, request an investor package, or call us at (866) 575-5070 if you have any questions.